Patient Organisations in China

August 2023:

Patient-advocacy groups are an increasingly important part of today’s healthcare landscape. First emerging in Western countries, where the history of mobilisation and influence was strong, the patient movement has since spread around the globe.

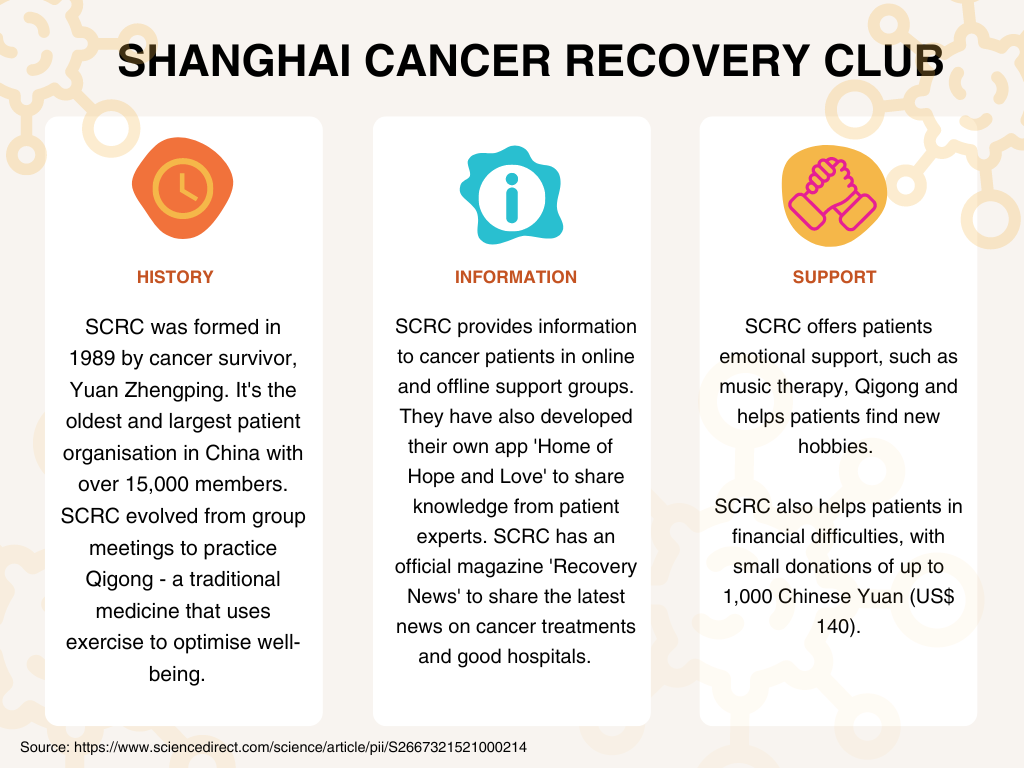

The phenomenon is relatively new in Asia, but member patient organisations in Asian countries are now proactive and influential—including in China. The Chinese patient movement is slightly over three decades old. The country’s first patient organisation is thought to be the Shanghai Cancer Recovery Club (SCRC), founded in 1989 [1].

Chinese patient groups must navigate a complex healthcare system. Major market-oriented reforms of 2009, aiming to generate more financing for the country’s healthcare system, have succeeded in producing improvements in health outcomes. Yet health inequalities still exist within China’s population. A 2022 study by the College of Public Administration, Huazhong University of Science and Technology, Wuhan, notes that the sheer scale of the mass migration of China’s rural populations towards the ever-growing big cities has made the supply of regular, reliable treatment and care to these urban localities increasingly challenging [2]. Meanwhile, rural populations continue to remain underserved by the healthcare system [3].

Population growth, coupled with increases in the life expectancy of Chinese people, has further strained the healthcare system. According to the ‘Global Burden of Disease Study’ (GBD) of 2019, the four-leading causes of morbidity and mortality in China are: chronic obstructive pulmonary disease; ischaemic heart disease; • lung cancer; and stroke—which used to be described as classic ‘Western’ diseases. The leading risk factors for disease in China are: air pollution; dietary factors; high systolic blood pressure; and tobacco smoking.

China’s patient movement has evolved within this changing healthcare scene to tackle the many problems facing the country’s patients. Chinese patient groups must work within the strict regulations imposed on civil associations [5]. So, unlike established patient groups in Europe and the United States, Chinese patient groups do not typically challenge regulatory authorities (although some do have effective links with local government), nor do they aggressively push for change. Instead, many Chinese patient groups serve as mediators between medical institutions and patients and work to find practical solutions for patients within the healthcare system as it currently exists.

However, during the past few years, a small number of Chinese patient groups (particularly those with an interest in rare diseases) have been petitioning central healthcare authorities for better treatment and care of the patients they represent—with, in some cases, success.[6] One such is HD Care, a patient group that acts on behalf of people with Huntington’s disease. An article for ‘Pharma Exec’, by Bruce Liu and colleagues from Simon-Kucher & Partners (a consultancy firm based in China), outlined the campaign strategy of HD Care: essentially, to convince regulatory authorities to approve a new treatment for Huntington’s [7]. An example of HD Care’s activities can be seen in the organisation’s despatch of around 100 letters to China’s National Medical Products Administration (NMPA) and the National Health Security Administration (NHSA) to advocate for the needs of Huntington’s patients. The direct result—China added Huntington’s disease to its rare-disease catalogue and the Huntington’s drug that HD Care had been pressing for was made available in the country in 2020.

What do Chinese patient groups say about pharma?

This August, PatientView, in the Asia element of the 2022 results of its annual ‘Corporate Reputation of Pharma’ survey, focuses, for the first time, on the views of patient groups from China (including their opinions on both the pharmaceutical industry in China and those on individual pharmaceutical companies trading in the country). As many as 87% of the 62 Chinese patient groups responding to the 2022 survey stated that they worked with pharmaceutical companies. These patient groups held the pharmaceutical industry in high regard—80% of respondent Chinese patient groups described the industry as having an “Excellent” or “Good” corporate reputation.

On the other hand, the Chinese patient groups (just like their Western counterparts) felt that pharma could do far more to improve patient access to medicines. Chinese patient groups called on pharma to make three improvements:better engagement of Chinese patient groups in pharmaceutical-company R&D; fairer drug-pricing policies; and greater levels of transparency from the industry.

[1] https://www.sciencedirect.com/science/article/pii/S2667321521000214

[2] https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0263577#sec015

[3] https://www.sciencedirect.com/science/article/pii/S2352827322003044

[4] https://www.thelancet.com/journals/lanpub/article/PIIS2468-2667(20)30268-1/fulltext

[5] https://www.sciencedirect.com/science/article/pii/S2667321521000214

[6] https://www.pharmexec.com/view/maximizing-china-access-for-innovative-therapies

[7] https://www.pharmexec.com/view/maximizing-china-access-for-innovative-therapies