What do Pharma companies find valuable in relationships with patient groups?

May 2024:

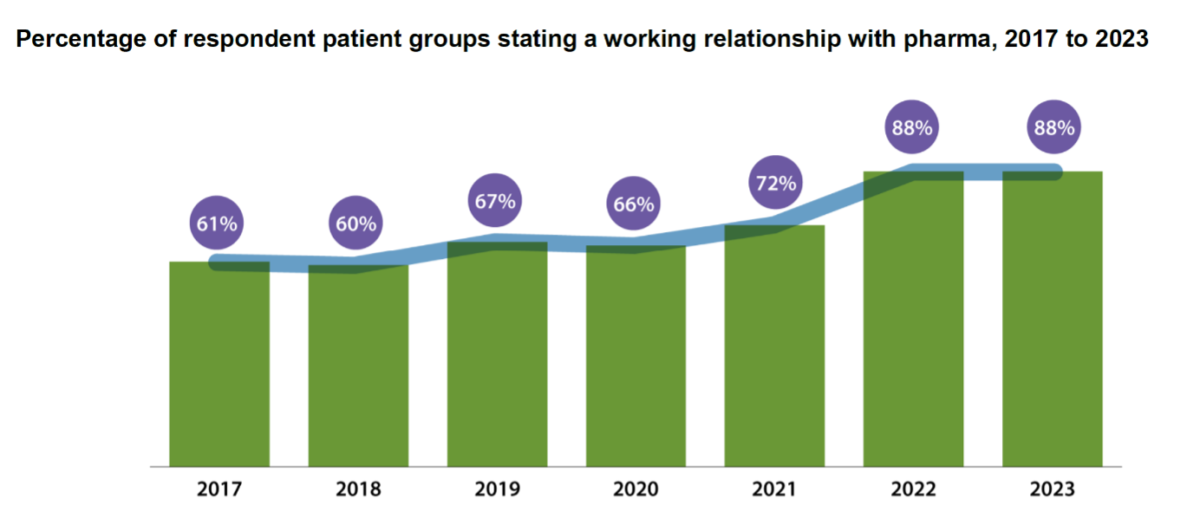

Links between pharmaceutical companies and patient groups are becoming increasingly common. Back in 2017, 61% of patient groups responding to that year’s ‘Corporate Reputation of Pharma’ survey mentioned having a working relationship with at least one pharmaceutical company. The 2023 and latest version of the survey finds the figure to be 88%. These links are now very much the rule, not the exception.

The growth in collaboration between patient groups and pharma companies, however, has occurred against a background of public suspicion about just what pharma companies are trying to gain from the contact. Various studies by academics and campaigners have wondered whether pharma companies are directing funds at patient groups to secure what could possibly be improper lobbying of regulators (or HTAs) by beneficiary patient groups [1]. The publications more often than not reach suggestive, rather than concrete, conclusions—hindered by a lack of data supporting their argument.

Patient groups must be aware of the risks that some such conduct does exist out there. Pharma companies themselves also well understand the reputational dangers involved whenever patient groups and pharma companies partner.

As Novo Nordisk notes in PatientView’s 2024 report, ‘What Companies Say About their Relations with Patient Groups, 2023-2024’: “Any collaboration and contact between pharma and patient organisations is scrutinised, and often leads to discredit of both patient organisations and the pharmaceutical company in question.”

So, if company/patient-group liaisons present such a potential minefield, what is it that pharma companies seek when committed to truly-meaningful relationships with patient groups?

So, if company/patient-group liaisons present such a potential minefield, what is it that pharma companies seek when committed to truly-meaningful relationships with patient groups?

The methodologies the companies outline in the ‘What Companies Say’ report—illuminating the main goals they hope for from their interaction with partner patient groups—also bear some striking similarities with each other.

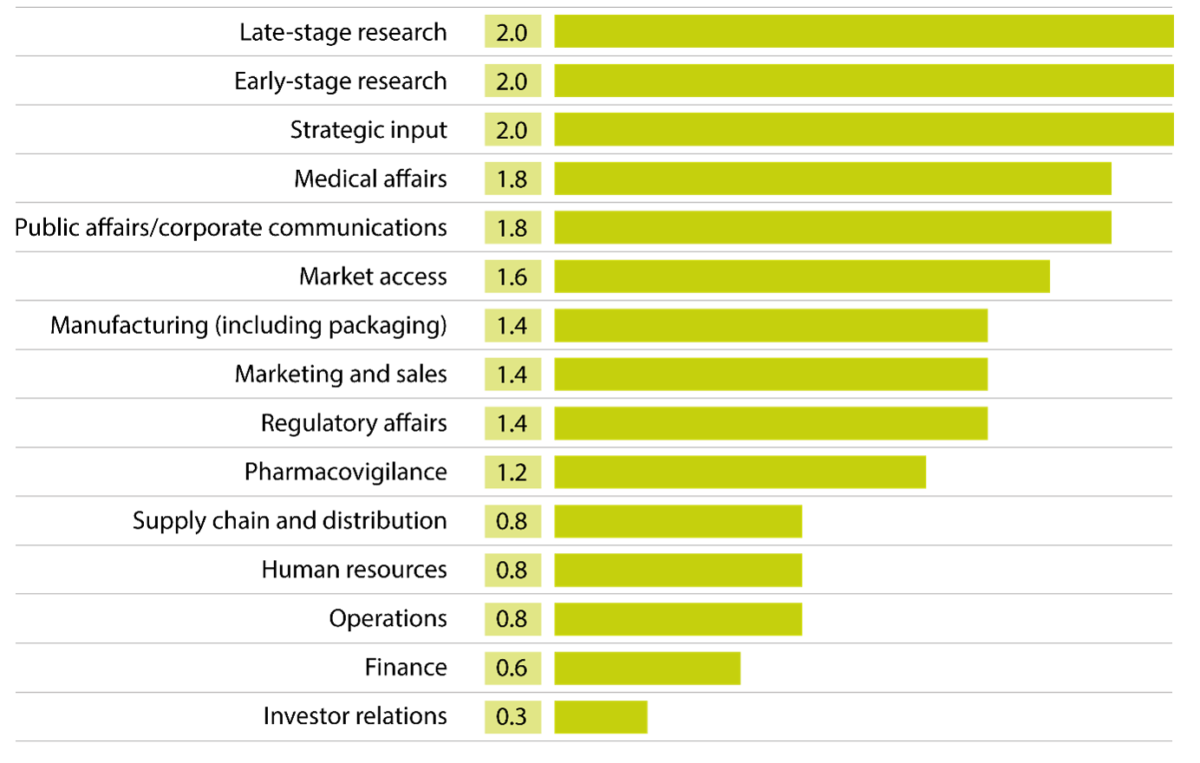

Five of the respondent pharma companies gave details about the nature of their relationships with their patient-groups partners. All five companies say that they regularly seek patient/patient-group input in research and development (at both early, and late, stages). Patient groups frequently mention hearing this claim from pharma companies—though, according to one Netherlands-based cancer patient group responding to the 2023 ‘Corporate Reputation’ survey, the reality sometimes falls short: “[Companies] will say that they engage patients in R&D—when, in actual fact, this might be a three-hour ‘advisory board’ in a phase-III trial, etc.”

How regularly do leading pharma companies seek patient input in the following areas?

On a scale of 0 to 2: where 0 = “Usually not”; 1 = “Sometimes”; and 2 = “Regularly”.

Average score for five pharma companies, with 2 being the highest-possible value.

Source: Assessments of five companies (Boehringer Ingelheim, Gilead, Novo Nordisk, Pfizer, and ViiV Healthcare), based on their submissions to PatientView’s ‘What Companies Say About their Relations with Patient Groups, 2023-2024’

The leading pharma companies writing in the ‘What Companies Say’ report, by contrast, make good-faith efforts to put words into practice. For example, when Boehringer Ingelheim promises to “Strive to systematically integrate patient insights—early in, and throughout, the entire-development process,” the company includes in its efforts, among other elements, an “Early Research Patient Steering Committee”, and updated “Patient-Experience Assessments (PEAs)” at every research milestone.

Meanwhile, Novartis writes in ‘What Companies Say’ that it is engaged in a comprehensive, innovative effort to measure the impact of patients’ proposals across the entire drug-product life cycle. Its Patient Engagement Impact Measurement Framework was developed with partner patient groups and outside experts to track, and to evaluate, the effects of priority patient-engagement activities, including: “understanding patients’ life experiences; patient opinions going into the company’s Target Product Profile; patient-focused drug development (including patient-preference studies, and feedback into clinical trials); patient input into strategic plans and dossiers; and co-creation of patient-directed materials and programmes.” The aim is not just to allow Novartis to benefit from increased levels of patient recommendations about its activities, but to formulate common metrics that can be adopted by the entire industry to raise standards.

Given the increasing emphasis on patient-focused drug development by the regulatory agencies of many jurisdictions,[2] extensive research partnerships between pharmaceutical companies and patient groups make sense for all parties. The correlations among the approaches taken by the pharma companies offering their stories to the ‘What Companies Say’ report, however, do not end here. In particular, the companies say that they regularly seek broad strategic involvement from patients and patient groups—though this does not mean patients being brought in to help run the company. Very few, if any, pharma companies ever seek patients’ views on matters of, say, finance, investor relations, or operations.

Rather, strategic input by patients and patient groups tends to fall under the umbrella of a general search for opportunities—whether medical or commercial—to find care that goes beyond the provision of treatments for specific conditions. For example, Pfizer tells the ‘What Companies Say’ report that it runs a Pan-Therapeutic Patient Centricity Advisors Council, set up to educate the company’s staff “on trends and issues that patient groups face, provide candid input on key patient-focused programs and resources, and collaborate with Pfizer colleagues and senior leadership to co-develop meaningful approaches to measure progress on behalf of patients.”

Beyond these areas, the contributing pharma companies also commonly draw on patient insights for their medical affairs—with most doing so, regularly. Joint efforts can go beyond simply working together to explain to clinicians how new treatments might provide better outcomes. Novo Nordisk, for example, collaborates with patient groups to encourage healthcare systems to take a more-holistic approach to chronic diseases. The company informs the ‘What Companies Say’ report that it is working with national patient groups in five countries on different chronic conditions related scientifically and societally (such as cardiovascular diseases, diabetes, liver disease, obesity, and osteoarthritis). The aim is to co-create research intended to help healthcare systems collectively address some of the growing burdens of each of these individual diseases.

The companies writing in the ‘What Companies Say’ report also work with patient groups on relevant questions of market access, regulatory affairs, and sales. About half of the firms, however, do so only sometimes. In aggregate, these three fields are important for industry leaders—but less so than the ones discussed above. The attitudes set out by these contributing companies are clearly inconsistent with the contention that pharma companies simply pay out money to patients and patient groups to turn them into lobbyists.

Of course, the picture described here refers to industry leaders, not necessarily to pharma as a whole. Many in the sector need to catch up—if they are to serve patients better, and to benefit more fully from patient insights. Some patients see signs of progress, fortunately. A US cancer patient group responding to the 2023 ‘Corporate Reputation of Pharma’ survey notes that “pharma companies play a lot of lip service [to patient partnership], but their tangible actions are lacking. That said, it is better than 10 years ago, when they didn’t even pay lip service. It’s a process.”

Pharma companies—certainly those mentioned in the ‘What Companies Say’ report—do not appear to want to stand still on patient engagement. Bayer speaks for many when it tells the report that “by 2030, we foresee the patient voice becoming even more pivotal in both our internal decision-making processes, and our external engagements. Patient insights and evidence will be integral in guiding our strategies and operations, integrated across geographies, methodologies, and the value chain.”

[1] For a review of this literature, see Alice Fabbri, et al., ‘Industry Funding of Patient and Health-Consumer Organisations: Systematic Review with Meta-Analysis,” BMJ, 2020, https://www.bmj.com/content/368/bmj.l6925

[2] For example, see …

- From the FDA: https://www.fda.gov/drugs/development-approval-process-drugs/fda-patient-focused-drug-development-guidance-series-enhancing-incorporation-patients-voice-medical;

- From the EMA: https://www.ema.europa.eu/en/documents/regulatory-procedural-guideline/ema-regulatory-science-2025-strategic-reflection_en.pdf;

- From the MHRA: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1022370/Patient_involvement_strategy.pdf.