What 555 Cancer Patients Groups Say about the Corporate Reputation of Pharma in 2022

June 2023:

Cancer is the leading cause of death worldwide. An estimated 18 million cases were reported in 2020[1], and the incidence rate of the disease is predicted to increase by 55% by 2040[2]. The four most common types of cancer globally are bowel, breast (female), lung, and prostate.

For several decades now, cancer patient groups have been a lifeline for cancer patients—and were especially so during the Covid-19 pandemic. Cancer patient groups typically raise public awareness about the disease, act as support networks for patients with cancer, and lobby healthcare stakeholders for better treatment and care. They press the pharmaceutical industry towards becoming ever more patient-centric. 555 cancer patient groups responded to the latest version of PatientView’s annual ‘Corporate Reputation of Pharma’ study, the 2022 survey, sharing their views on the pharma industry, and assessing it on ten indicators of corporate reputation (including equitable access to medicines, fair pricing, and innovation).

Key Findings from the 2022 ‘Corporate Reputation of Pharma’ Exercise: The pharmaceutical industry’s record of innovation in the field of cancer gives the industry a high corporate reputation among cancer patient groups

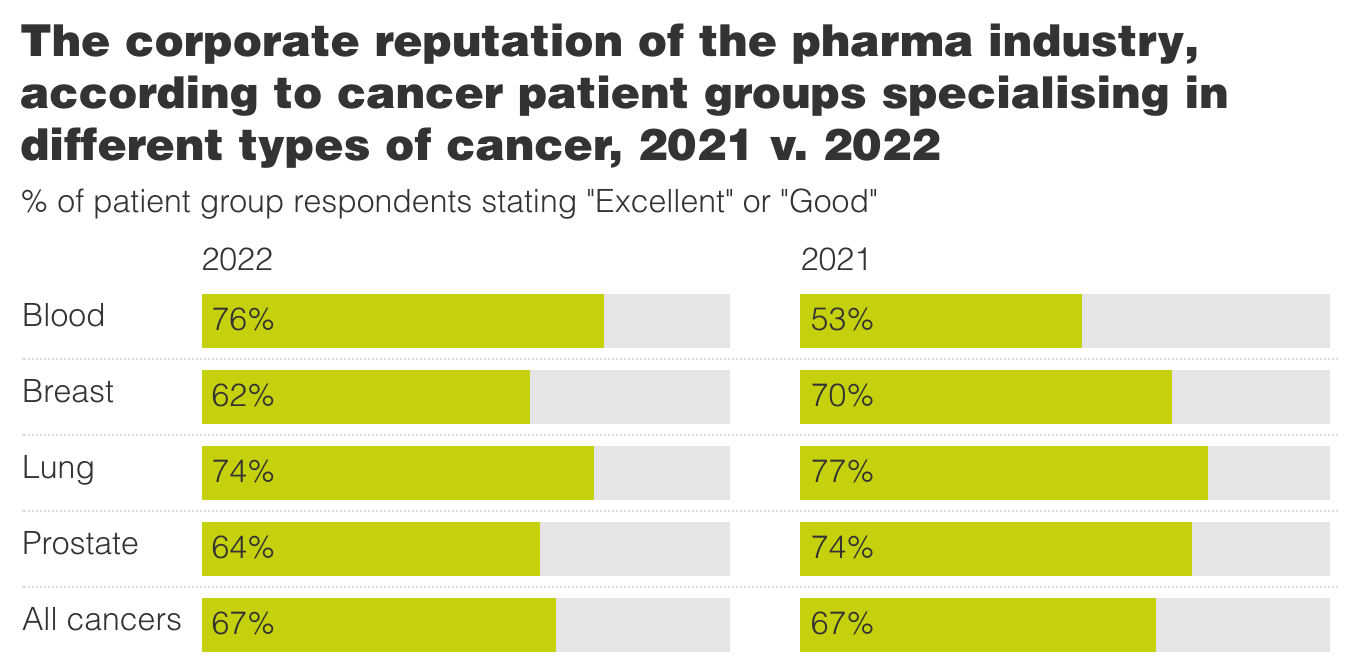

Cancer patient groups assess the corporate reputation of the pharmaceutical industry to have risen steadily over the last ten years (since PatientView first started tracking the views of cancer patient groups). In 2013, just 38% of cancer patient groups stated that the pharma industry had an “Excellent” or “Good” corporate reputation; by 2022, the equivalent figure had grown to 67%.

Cancer patient groups assess the corporate reputation of the pharmaceutical industry to have risen steadily over the last ten years (since PatientView first started tracking the views of cancer patient groups). In 2013, just 38% of cancer patient groups stated that the pharma industry had an “Excellent” or “Good” corporate reputation; by 2022, the equivalent figure had grown to 67%.

However, these improvements in cancer patient-group perceptions of pharma are not common across all types of cancer. Although 76% of 2022’s respondent blood-cancer patient groups saw pharma as having an “Excellent” or “Good” corporate reputation (a significant improvement from 2021’s 53%), patient groups specialising in breast, lung, or prostate cancer had lowered opinions of the industry over the same period.

Cancer patient-group perceptions of pharma are largely driven by the industry’s record at improving treatment options and outcomes for cancer patients—and by those patients’ ability to access new cancer treatments.

Cancer patient-group perceptions of pharma are largely driven by the industry’s record at improving treatment options and outcomes for cancer patients—and by those patients’ ability to access new cancer treatments.

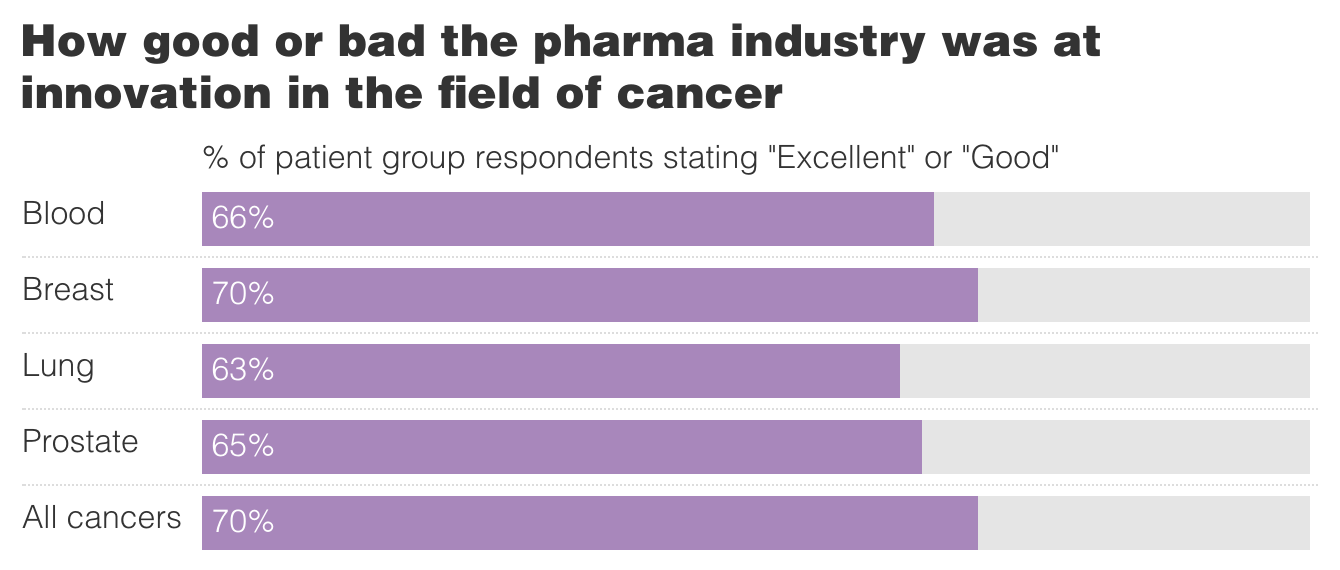

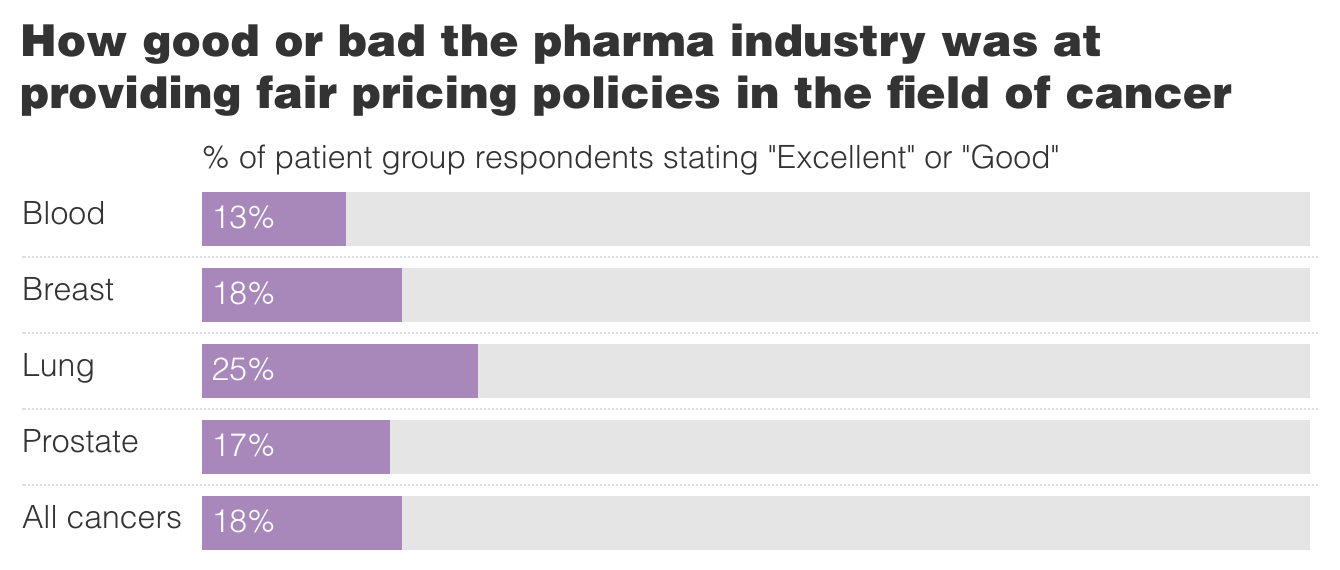

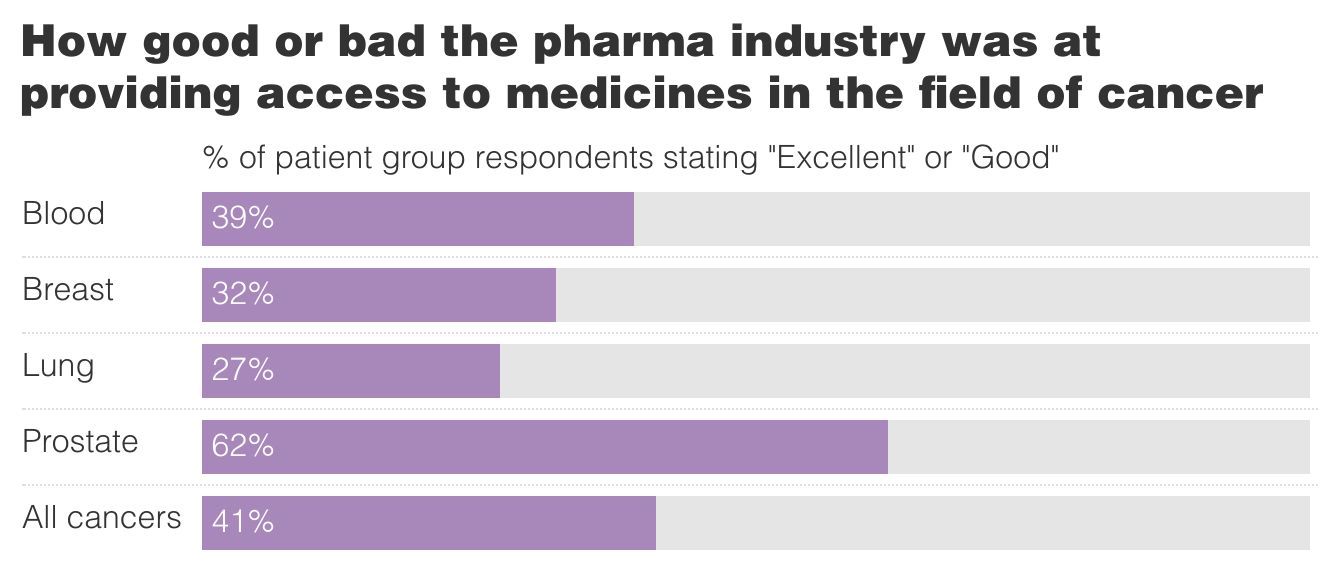

In 2022, the 15-largest pharmaceutical companies invested a record-breaking $138 billion in research and development (all drugs). Out of over 6,000 drug candidates in development, 38% were oncology candidates.[3] Not surprisingly, then, 70% of 2022’s 555 respondent cancer patient groups believed pharma “Excellent” or “Good” at innovation in the field of cancer. However, just 41% of these respondent cancer patient groups thought pharma “Excellent” or “Good” at ensuring that patients with cancer get access to cancer medicines. A key reason for the belief among cancer patient groups that pharma is not doing too well in this regard are the high prices attached to new cancer therapies. According to a 2022 report drafted by US Democratic Representative Katie Porter (a consumer-bankruptcy law professor), six out of eight newly launched oral cancer drugs were priced over $200,000 per year.[4]

Fair Pricing, and Pharma’s Corporate Reputation

Innovative cancer therapies generally tend to be costly enough to adversely impact patient access.

New cancer drugs, despite being approved for treatment, are all too often unaffordable to national healthcare systems, forcing the healthcare systems and the manufacturers into protracted price negotiations—thereby further delaying patient access to novel cancer treatments.[5] The majority of 2022’s respondent cancer patient groups were indeed worried that the high pricing of new cancer treatments was compromising patient access to these medicines.

New cancer drugs, despite being approved for treatment, are all too often unaffordable to national healthcare systems, forcing the healthcare systems and the manufacturers into protracted price negotiations—thereby further delaying patient access to novel cancer treatments.[5] The majority of 2022’s respondent cancer patient groups were indeed worried that the high pricing of new cancer treatments was compromising patient access to these medicines.

Patient access to medicines is a global crisis that pharma companies have, however, made efforts to address. One example is the Access to Oncology Medicines (ATOM) Coalition, an initiative formed by several large pharma companies, with the aim of improving access to essential cancer medicines in poorer countries[6].

Patient access to medicines is a global crisis that pharma companies have, however, made efforts to address. One example is the Access to Oncology Medicines (ATOM) Coalition, an initiative formed by several large pharma companies, with the aim of improving access to essential cancer medicines in poorer countries[6].

How can the Pharmaceutical Industry Improve at Patient Access?

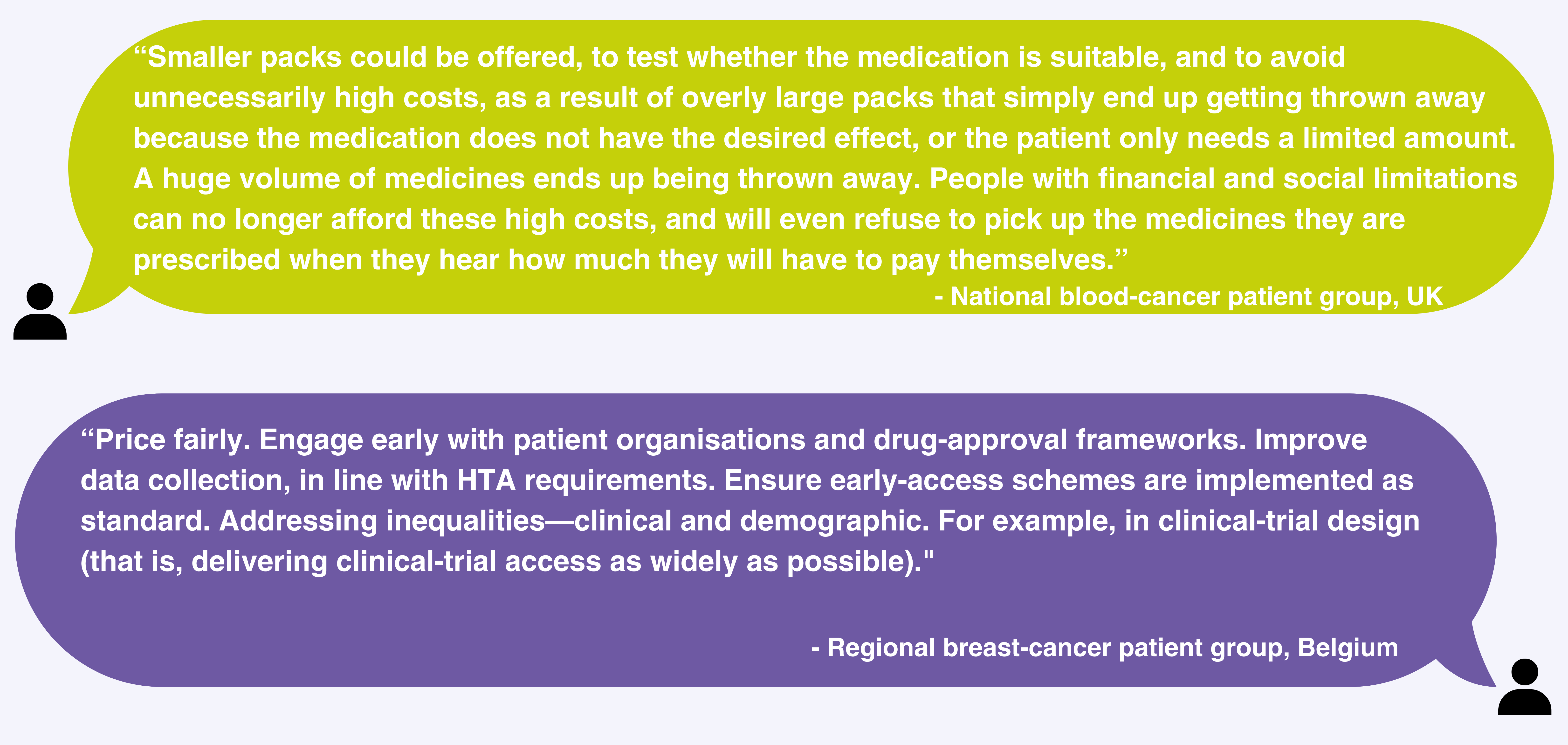

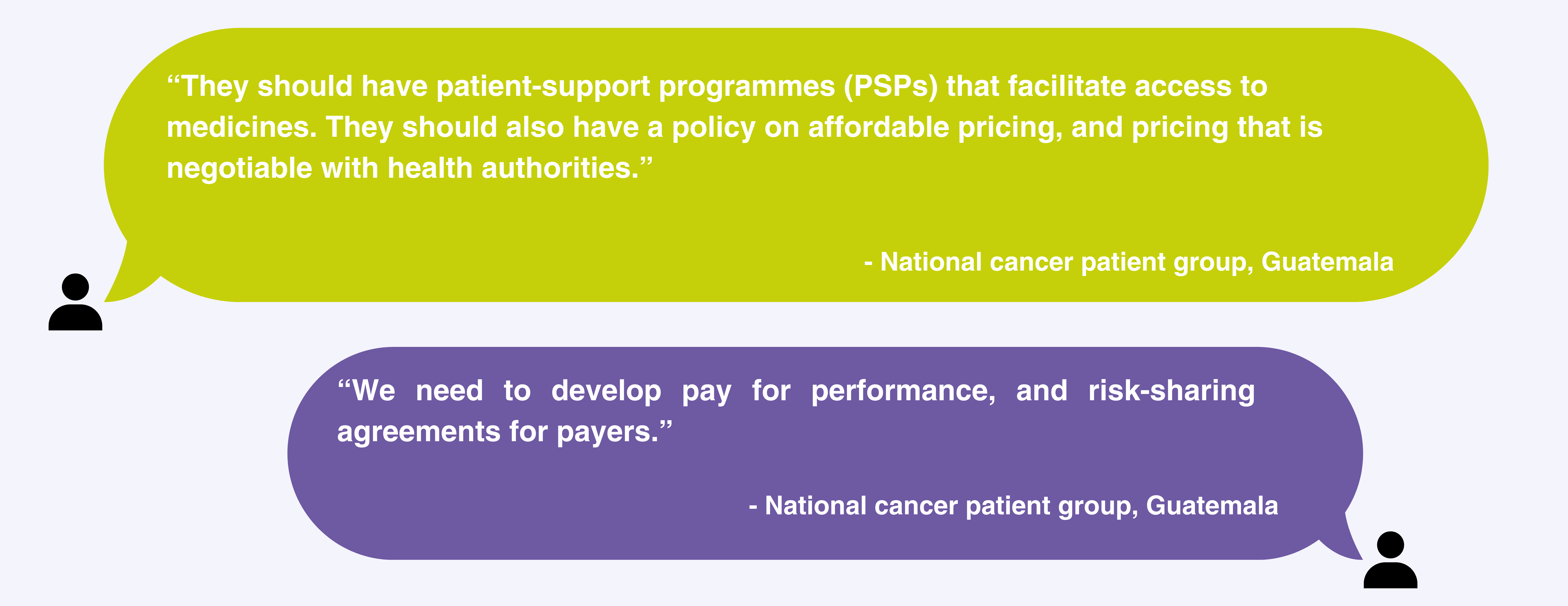

Cancer patient groups responding to the 2022 PatientView ‘Corporate Reputation of Pharma’ survey provided numerous ideas as to how the industry might boost patient access to cancer medicines.

Here are a few of their suggestions …

[1] https://www.cancerresearchuk.org/health-professional/cancer-statistics/worldwide-cancer#:~:text=Incidence%20worldwide,of%20all%20cancers%20diagnosed%20worldwide.

[1] https://www.cancerresearchuk.org/health-professional/cancer-statistics/worldwide-cancer#:~:text=Incidence%20worldwide,of%20all%20cancers%20diagnosed%20worldwide.

[2] https://www.cancerresearchuk.org/health-professional/cancer-statistics/worldwide-cancer/incidence

[3] https://seekingalpha.com/news/3944195-pharma-research-developmeny-funding-soared-to-a-new-record-in-2022-as-oncology-candidates-dominate-pipelines

[5] https://ascopubs.org/doi/full/10.1200/EDBK_100028

[6] https://www.fiercepharma.com/pharma/novartis-hands-over-tasigna-patent-new-coalition-improve-cancer-drug-access-poorer-countries